The Impact of NLP on Transforming Finance, FinTech, and Banking

In our new article we will explore the impact of natural language processing in finance, enhancing data analysis, customer interactions, and regulatory compliance for improved financial services.

Natural Language Processing-a nascent technology-is now changing the way machines interact with human language in finance. NLP in finance is changing how financial organizations analyze data, interact with customers, and make sure that regulations are complied with. Increased usage by FinTech firms applying advanced technologies in financial NLP services has accelerated the pace of NLP. In this way, a firm can make use of large volumes of unstructured data to make informed decisions and manage its operations effectively. The hedge funds, such as Renaissance Technologies, employ news articles and social media to detect sentiment. They gauge the tone and context of the debates on a stock to make informed decisions, often capitalizing on shifts in market sentiment before they are widely recognized. It not only enhances their investment strategies but enables them to handle risks more appropriately.

How Natural Language Processing Revolutionizes Financial Services

NLP in finance provides automation of routine jobs, deeper insight into customer behavior, and analysis of market trends. It can describe trends by analyzing the unstructured text data of news articles, social media, and financial reports. This insight will definitely help such institutions win the race. A concrete example of putting NLP finance into action is with chatbots in customer service. Banks like Bank of America deploy AI-run chatbots that instantly answer queries on account balance, transaction history, loan application status, and so on. It helps increase customer satisfaction while, on the other hand, reduces operational costs by decreasing the number of calls dealt with by human representatives. Chatbots can work 24/7, that means the customers are given support at any time they require it. Find out more insights in chatbot development services.

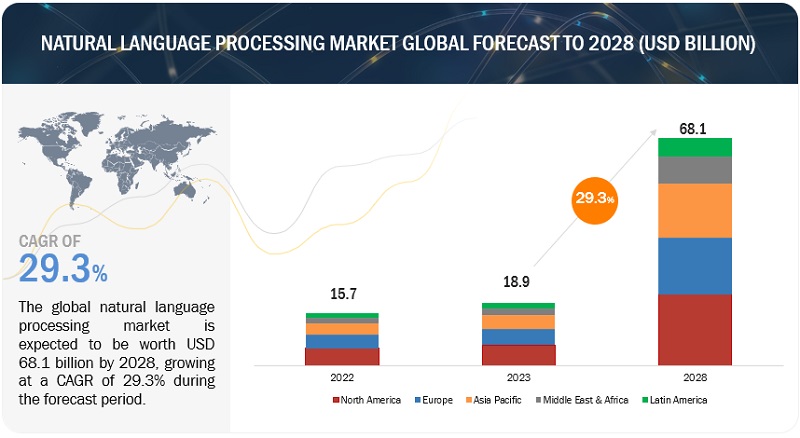

Image from MarketsandMarkets (source)

Image from MarketsandMarkets (source)

The Role of NLP in Modernizing Financial Services

Present-day financial services are fast becoming inclined towards data-driven decision-making. NLP will become important in this transition by making available tools that can process and analyze mass volumes of unstructured data. Natural language processing finance enables financial institutions to renew their operations with automation, better customer service, and increased compliance standards. Companies like Deloitte have already started using NLP for finance in the automation of financial reporting. The algorithms will extract data from related documents, such as invoices and contracts, and summarize the performance of a company in reports without human intervention. NLP for finance doesn’t only save time, but it also eliminates the possibility of human mistakes. An automated reporting system frees up the financial professional from data collection to providing strategic analysis by giving fast insight into various areas.

Use Cases of NLP in Finance

Gaining Insights from Unstructured Financial Data

Financial analysts have often been challenged by large volumes of data in unstructured nature: reports, news articles, and social media posts. NLP techniques help in deriving meaningful insights from such data to aid analysts in making better decisions. For instance, a financial institution might want to analyze Twitter feeds and news articles around a particular company. By using sentiment analysis, analysts can say whether the market sentiment is positive, negative, or neutral and hence was considered to predict how it would respond to upcoming earnings or product releases. This can give an organization a competitive advantage in that it can easily change its strategies based on real-time sentiment information. Watch NLP in data science for more details on NLP and applications.

Streamlining Regulatory Compliance

Compliance is perhaps one of the most important aspects of finance, and NLP can strongly ease the process. This is where NLP can analyze regulatory texts and guidelines to help the firm understand whether it is in compliance or not. Companies like ComplyAdvantage in RegTech apply NLP for the monitoring of changes in regulations issued in various jurisdictions. Their systems study automatic, regular changes in regulations, thus alerting the compliance officer to make necessary adjustments and hence reducing the chances of non-compliance. In this way, automation of such processes can enable firms to focus on proactive compliance management rather than its reactive measures.

Enhancing Investment Research through NLP

Investment research has traditionally been a labor-intensive process. NLP can automate the extraction of relevant information from financial reports and news articles, allowing analysts to focus on higher-level strategic thinking. Tools like Bloomberg Terminal integrate NLP to provide analysts with real-time news analysis and sentiment scoring related to various stocks, enabling them to quickly assess the potential impact on investments. This capability allows firms to make timely decisions based on the latest market developments.

Elevating Customer Experience in Financial Services

Basically, investment research has been a very manual kind of activity. NLP will automate the extraction of relevant information from financial reports and news articles to free up analysts for more high-order strategic thinking. Bloomberg Terminal uses integrated NLP capabilities that offer real-time news analytics and sentiment scores about various stocks; these let analysts quickly grasp the likely implications for their investments. It grants the firms the ability to make timely decisions based on what is taking place within the markets.

Optimizing Portfolios with NLP Techniques

It can also be applied to the optimization of investment portfolios. The NLP models provide insights into the analysis of market sentiment and financial news, thus helping to make various adjustments to the strategy for the portfolio manager. This approach facilitates the continuous assessment of market sentiment and news events by an investment firm with respect to its portfolios, which may permit timely changes in asset allocation to take advantage of emerging trends, and thereby maximize return while minimizing risks.

Predicting Stock Movements Using NLP Models

Predictive analytics is one of the powerful uses of NLP in finance. With a certain degree of accuracy, an NLP model analyzes historical data, news sentiments, and social media trends in order to predict stock movements. Companies such as QuantConnect use NLP for building predictive trading algorithms that analyze news article sentiment and tweets for predicting the movement of stock prices. Such models may provide actionable insights to traders and help them arrive at efficient and effective decisions in a timely manner.

Image from John Snow Labs (source)

Image from John Snow Labs (source)

Improving Financial Accounting and Auditing

NLP will make financial accounting and auditing processes more efficient. NLP reduces the time and effort used in audits by automating the extraction of relevant information from financial documents. Firms like PwC are using NLP tools in auditing to automate the analysis of financial statements in search of inconsistencies, hence making the process easier. Apart from improving accuracy, it frees auditors to perform other complicated tasks related to their jobs, such as risk assessment.

Financial Document Processing with NLP

With NLP, financial documents such as contracts and invoices are easier to handle. By automating data extraction and classification, the organization saves itself from manual errors, increasing efficiency. Organizations such as Kofax offer NLP-driven solutions to automate invoice processing for companies. The companies can, therefore, extract relevant data and reduce processing times considerably. Automating this decreases bottlenecks within the accounts payable process, thus allowing more payables and closer relations with suppliers.

Fraud Detection and Prevention with NLP

Fraud detection is one of the major serious concerns that financial institutions are worrying about. NLP can analyze various transaction data and customer communications for known patterns signaling fraud. Banks like HSBC use NLP algorithms to monitor transactions and flag unusual patterns, thereby averting fraud from taking place. By implementing the power of NLP for real-time analysis, these institutions can act upon such potential threats with speedy reaction times and also help in saving their assets and customers.

Challenges of NLP in Financial Services

Having so many advantages, the implementation of NLP in financial services has its own challenges. Still, people are trying to incorporate these technologies since they hold the keys to the future.

Ensuring Data Privacy and Security

Finance NLP is engaged in sensitive information, and that makes data privacy and security very crucial. The implementation of finance NLP solutions has to be done by strictly adhering to regulations related to data protection in order to protect the customer’s information. In summary, financial institutions will be required to make encryption and adhere to the regulations like GDPR to protect them from the compromise of data caused by the NLP applications. We have told you about such regulatory rules already; read about it on our website. Compliance would provide a shield not only to customer information but also improve the reputation and credibility of the institution itself.

Maintaining Data Quality in NLP Applications

Much of the power of NLP models lies in the truth of the data they process, and inaccuracies or incompleteness can easily lead to misleading insights. In this regard, strong data management practices in which rigorous data validation is performed become very critical to ensure that quality and accurate data are fed into the NLP models. Periodic data quality audits can help minimize some of those risks emanating from poor data management practices and further improve the overall effectiveness of the NLP applications.

Lack of Explanation for NLP-based Rejections

One potential disadvantage with NLP models is that they tend to produce non-transparent outcomes-that is, it could be hard to tell why the system arrived at a particular decision. For many regulated sectors, such as financial services, this “black box” element of AI is a challenge, as explanations about decisions are generally required. Consequently, some financial organizations have started investing in explainable AI projects that give insight into how NLP models make conclusions. Each of these initiatives represents a key demand that has to be met to sustain accountability and trust in processes of automated decision-making.

High Costs Associated with NLP Implementation

Entry into the technology of NLP could be quite cost inputs, especially for the small firms. This will remain a key consideration for the financial institutions in balancing costs with benefits.

This return on investment study will help these institutions to capture how much they are gaining in the long run, from investments in NLP. ROI stands for Return on Investment, and it is a sort of ratio that helps to evaluate an investment by comparing its gain to the cost to show the profitability. In doing this, one may try to calculate how much one is likely to obtain as returns from investment initiatives in stocks, startups, or any other form of venture. Well-defined metrics of success will help quantify the impact that NLP has on business outcomes.

Image from Pexels (source)

Image from Pexels (source)

Benefits of NLP in Financial Services

The benefits of integrating NLP in financial services are great.

The Growing Impact of NLP in the Finance Industry

Considering the dynamics in increasing order within the financial world, with each passing day, the sphere of NLP’s influence is greater. Those financial institutions that get into the groove of adopting NLP technologies create a platform for gaining competitive advantage through enhancements in data analysis, customer service, and compliance measures.

Transforming the Role of Research Analysts with NLP

But NLP is changing the role of the research analyst, automating routine tasks and freeing them to undertake higher-value activities. This transformation will unlock more strategic data & analytics services and better-informed investment decisions. Equipped with NLP tools that automate data gathering and preliminary analysis, analysts can spend more time interpreting results and developing strategic recommendations, raising overall quality in investment research.

How NLP Enhances Compliance Officer Efficiency

First, the advantages involve smoothing the work of compliance officers as they carry out monitoring activities for all changes in regulatory updates, including those in internal policies. In this regard, some automation of the tasks would mean less overstretching of resources to maintain compliant operations within the firm. This could be extended by applying NLP toward real-time monitoring of updates to regulatory requirements whereby compliance teams can attain a proactive stance and handle issues before they get worse to enhance resilience within an organization.

Leveraging NLP for Investment Firm Success

In the process, investment firms using NLP make massive steps toward the analysis of market trends, improvement of interactions with their customers, and enhancement of their strategies toward the realization of long-term success in a competitive market.

Image from Pexels (source)

Image from Pexels (source)

Exploring the Future of NLP in Finance

The future for NLP in finance is bright and constantly developing since machine learning and AI technologies are further being improved. Development means that their applications also develop within finance, creating ever more sophisticated tools and methodologies. Evolving technologies like blockchain might combine with NLP to enhance transparency and security in financial dealings. This may further enable secure and efficient outsourcing image processing services and start to develop the next revolution.

Conclusion

NLP use in financial services gives the much-required power for improved data analysis, customer interactions, and acceleration in compliance matters. Financial organizations can use NLP to gain better insights from the vast streams of unstructured data-news, reports, and social media-coming their way and quickly make it possible for institutions to stay ahead of the market trends and be more proactive with regard to investment strategies. AI-powered chatbots also find their application in banking, where they can immediately attend to customer queries while saving them operation costs. Operating 24/7, these tools heighten customer satisfaction while reducing call volumes for human representatives. With NLP, the future of finance really looks bright.

FAQ

How does NLP improve data analysis in financial services?

NLP helps analyze data by making insights extraction automated from unstructured data sources, such as news articles or social network posts. This would also provide the financial analyst with more insightful and quicker decision-making to enhance efficiency overall.

What tools and software use NLP for financial analysis?

Several tools and software have been using NLP for financial analysis, including, but not limited to, Python libraries like NLTK and spaCy, among others, and IBM Watson. These provide the infrastructure required for more complex NLP models focused on this area of applications.

Can NLP help in predicting market trends?

Yes, NLP will analyze sentiment and trends from diverse data sources into useful insight that will be helpful in predicting market movements and hence aids in making appropriate investment decisions. An application of NLP can reveal regular patterns through constant monitoring and analysis that could give a warning of future market behaviors.